Asia Pacific Academy of Science Pte. Ltd. (APACSCI) specializes in international journal publishing. APACSCI adopts the open access publishing model and provides an important communication bridge for academic groups whose interest fields include engineering, technology, medicine, computer, mathematics, agriculture and forestry, and environment.

NFTS: The evaluation of standards and price volatility

Vol 7, Issue 1, 2026

Download PDF

Abstract

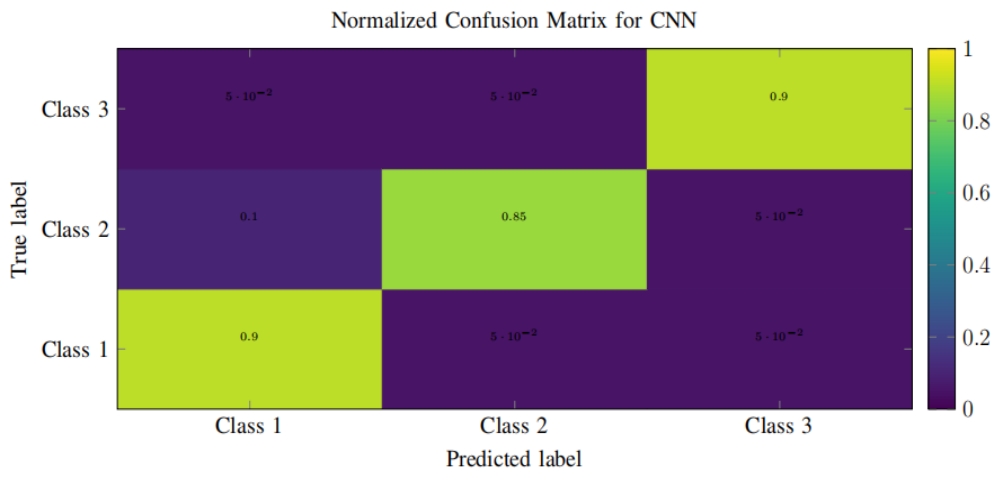

The latest technology Non-Fungible Token (NFT) supports ownership of objects on the internet; everyone wants to reap the maximum of this opportunity. The price of the NFT shot up overnight, creating a market with trading volumes of millions worth, but there seem to be issues related to the legitimacy of this technology. Some countries define the legality of NFTs, cryptocurrencies, and cryptocurrency-based smart contracts, but they are just a handful of them; there requires the assessment of standards in NFT for full-fledged expansion throughout the world. The majority of the problems are related to the security of the users, price volatility of NFTs, and copyright issues. In this research, the evaluation is achieved by applying methods to identify the standards present in the current NFT ecosystem. The methods acquire quantitative and qualitative information to analyze it by designing models based on Correlation and Total Connectedness Index formulas to give the perspective of the inter relation between NFTs and other financial assets and deeply examine the technology's compliance with the regulations like KYC requirements and copyright registrations. The research uses numerical and non-numerical data from various sources, which are familiar with the crypto community. The results manifest the standards of NFTs, stabilization measures to the NFT market, and it guides investors, developers, and entrepreneurs. May be there is a prerequisite for the design change, viewpoint for alternative replacements for establishing smart contracts between the parties engaged in NFT ventures. Contemplating the level of centralization required on NFTs for protection of the stakeholders in the financial market.

Keywords

References

1. Eltahami M, Abdullah M, Talip BA. Identity verification and document traceability in digital identity systems using non-transferable non-fungible tokens. In: Proceedings of the 2022 International Visualization, Informatics and Technology Conference (IVIT); 14–15 November 2022; Kuala Lumpur, Malaysia. https://doi.org/10.1109/IVIT55443.2022.10033362

2. Abubakar M, Gunathilake NA, Buchanan WJ, O'Reilly B. A review of the non-fungible tokens (NFT): Challenges and opportunities. In: Big Data Technologies and Applications. Springer Nature Switzerland; 2023. pp. 171–190. https://doi.org/10.1007/978-3-031-52265-9_12

3. Cao Y, Shi Q, Shen L, Chen K, Wang Y, Zeng W, Qu H. NFTracer: tracing NFT impact dynamics in transaction-flow substitutive systems with visual analytics. IEEE Transactions on Visualization and Computer Graphics. 2024. https://doi.org/10.1109/TVCG.2024.3402834

4. Chang CW, Lai CJ, Yen CC. Examining drivers of NFT purchase intention: The impact of perceived scarcity and risk. Acta Psychologica.2024;248:104424. https://doi.org/10.1016/j.actpsy.2024.104424

5. Zhang L, Phang IG. How NFTs contribute to consumers' purchase intention towards luxury fashion physical products. Journal of Fashion Marketing and Management. 2025;29(3):496–519. https://doi.org/10.1108/JFMM-07-2024-0260

6. Pramod D, Bharathi S V, Patil KP. Tokenizing Tangible Intentions: Unraveling the Motives to Try NFTs. Journal of Computer Information Systems. 2024:1–14. https://doi.org/10.1080/08874417.2024.2371428

7. Finken D, Döring T, Hofstetter R. Fragile permanence: How NFTs shape perceptions of artistic identity and value. Journal of the Association for Consumer Research. 2025;10(2):137–152. https://doi.org/10.1086/734656

8. Urom C, Ndubuisi G, Guesmi K. Dynamic dependence and predictability between volume and return of Non-Fungible Tokens (NFTs): The roles of market factors and geopolitical risks. Finance Research Letters. 2022;50:103188. https://doi.org/10.1016/j.frl.2022.103188

9. Jiang M, Xia Y. What drives the volatility of non-fungible tokens (NFTs): macroeconomic fundamentals or investor attention?. Applied Economics Letters. 2024;31(16):1439–1448. https://doi.org/10.1080/13504851.2023.2187034

10. Kräussl R, Tugnetti A. Non‐fungible tokens (NFTs): A review of pricing determinants, applications and opportunities. Journal of Economic Surveys. 2024;38(2):555–574. https://doi.org/10.1111/joes.12597

11. Alshater MM, Nasrallah N, Khoury R, Joshipura M. Deciphering the world of NFTs: a scholarly review of trends, challenges, and opportunities. Electronic Commerce Research. 2025;25(5):4193–4249. https://doi.org/10.1007/s10660-024-09881-y

12. Saudarshan H. Risk, Sustainability, and Future of NFT Marketplaces: A Quantitative, Blockchain, Policy-Based, and Interdisciplinary Analysis. SSRN. 2025. https://doi.org/10.2139/ssrn.5200486

13. Anwar R, Raza SA. Exploring the connectedness between non-fungible token, decentralized finance and housing market: Deep insights from extreme events. Heliyon. 2024;10(20):e38224. https://doi.org/10.1016/j.heliyon.2024.e38224

14. Cho E, Jensen G, Yoo Y, Mahanti A, Kim JK. Characterizing the initial and subsequent NFT sales market dynamics: Perspectives from boom and slump periods. IEEE Access. 2023;12:3638–3658.

https://doi.org/10.1109/ACCESS.2023.3333897

15. Razi Q, Devrani A, Abhyankar H, Chalapathi GSS, Hassija V, Guizani M. Non-fungible tokens (NFTs)-Survey of current applications, evolution, and future directions. IEEE Open Journal of the Communications Society. 2023;5:2765–2791.

https://doi.org/10.1109/OJCOMS.2023.3343926

16. Ante L. The non-fungible token (NFT) market and its relationship with Bitcoin and Ethereum. FinTech. 2022;1(3):216–224. https://doi.org/10.3390/fintech1030017

17. Hasan M, Chowdhury MJM, Biswas K, Hasan M, Islam S. Exploring the Security Landscape of NFT Transactions. IEEE Access. 2025. https://doi.org/10.1109/ACCESS.2025.3641962

18. JY Tan L. NFT security. In: Web3 Applications Security and New Security Landscape: Theories and Practices. Springer Nature Switzerland; 2024. pp. 19–34. https://doi.org/10.1007/978-3-031-58002-4_2

19. Mustafa G, Rafiq W, Jhamat N, Arshad Z, Rana FA. Blockchain-based governance models in e-government: a comprehensive framework for legal, technical, ethical and security considerations. International Journal of Law and Management. 2025;67(1):37–55. https://doi.org/10.1108/IJLMA-08-2023-0172

20. Guadamuz A. The treachery of images: non-fungible tokens and copyright. Journal Of Intellectual Property Law and Practice. 2021;16(12):1367–1385. https://doi.org/10.1093/jiplp/jpab152

21. Chalmers D, Fisch C, Matthews R, Quinn W, Recker J. Beyond the bubble: Will NFTs and digital proof of ownership empower creative industry entrepreneurs?. Journal of Business Venturing Insights. 2022;17:e00309.

https://doi.org/10.1016/j.jbvi.2022.e00309

22. Rokni SF, Yavari M. Exploring Non‐Fungible Tokens: A Bibliometric Analysis and Future Research Opportunities. Journal of Economic Surveys. https://doi.org/10.1111/joes.70022

23. Hunhevicz JJ, Hall DM. Do you need a blockchain in construction? Use case categories and decision framework for DLT design options. Advanced Engineering Informatics. 2020;45:101094. https://doi.org/10.1016/j.aei.2020.101094

24. Febrero P, Pereira J. Cryptocurrency constellations across the three-dimensional space: Governance decentralization, security, and scalability. IEEE Transactions on Engineering Management. 2020;69(6):3127–3138.

https://doi.org/10.1109/TEM.2020.3030105

25. Md Shafin K, Reno S. Breaking the blockchain trilemma: A comprehensive consensus mechanism for ensuring security, scalability, and decentralization. IET Software. 2024;2024(1):6874055. https://doi.org/10.1049/2024/6874055

26. Maidin SS, Yang Q, Samson AS. Analyzing the Evolution of AIGenerated Art Styles Using Time Series Analysis: A Trend Study on NFT Artworks. Journal of Digital Market and Digital Currency. 2025;2(2):205–229.

https://doi.org/10.47738/jdmdc.v2i2.32

27. Boido C, Aliano M. Digital art and non-fungible-token: Bubble or revolution?. Finance Research Letters. 2023;52:103380. https://doi.org/10.1016/j.frl.2022.103380

28. Phan TA, Hoai TT. Chasing the scarcity: How fear of missing out and motivations drive willingness to pay in collectible markets. Journal of Marketing Communications. 2025:1–15. https://doi.org/10.1080/13527266.2025.2461143

29. Peng S, Prentice C, Shams S and Sarker T. A systematic literature review on the determinants of cryptocurrency pricing. China Accounting and Finance Review. 2024;26(1), pp.1–30. https://doi.org/10.1108/CAFR-05-2023-0053

30. Pradana M, Wai Shiang C, Abdullah KB, Saputri ME, Nabila FS. Revisiting non-fungible token (NFT) research trends: a bibliometric study and future research directions. Cogent Business & Management. 2025;12(1).

https://doi.org/10.1080/23311975.2025.2469764

31. Gunay S, Kaskaloglu K. Does utilizing smart contracts induce a financial connectedness between Ethereum and non-fungible tokens? Research in International Business and Finance. 2022;63:101773. https://doi.org/10.1016/j.ribaf.2022.101773

32. Weinberg AI, Petratos P, Faccia A. Will Central Bank Digital Currencies (CBDC) and blockchain cryptocurrencies coexist in the post quantum era? Discover Analytics. 2025;3(1):8. https://doi.org/10.1007/s44257-025-00034-5

33. Hartwich E, Ollig P, Fridgen G, Rieger A. Probably something: A multi-layer taxonomy of non-fungible tokens. Internet Research. 2024;34(1):216–238. https://doi.org/10.1108/INTR-08-2022-0666

34. Shkliar AI. The phenomenon of central banks' digital currencies (CBDC): key attributes and implementation perspectives. Ukrainian Society. 2020;1(72):123–137. https://doi.org/10.15407/socium2020.01.123

35. Kuzior A, Sira M. A bibliometric analysis of blockchain technology research using VOSviewer. Sustainability. 2022;14(13):8206. https://doi.org/10.3390/su14138206

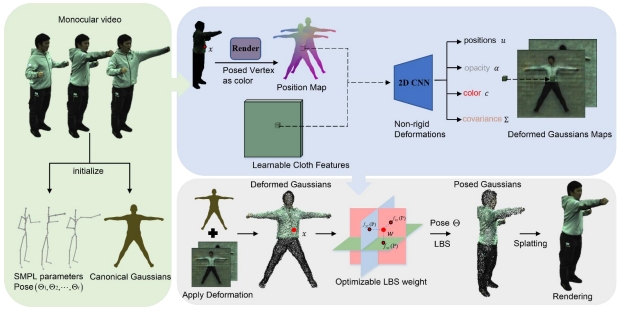

36. Saxena P, Jamshed A, Singh SK, Saxena S, Aggarwal SK. Bridging deep segmentation and metaverse visualization: Cellpose-based 3D brain tumor reconstruction from MRI. Metaverse. 2025;6(3). https://doi.org/10.54517/m3727

37. Jamshed A, Saxena P, Saxena S, Aggarwal SK. Metafusion: hybrid ML-based object recognition and GPU rendering for real-time 3D metaverse visualization. Metaverse. 2025;6(3). https://doi.org/10.54517/m3728

38. Singh AK, Saxena S, Tripathi A, Singh A, Tiwari S. Futuristic challenges in blockchain technologies. In: Blockchain and Deep Learning for Smart Healthcare. Wiley; 2023. pp. 45–74. https://doi.org/10.1002/9781119792406.ch3

Supporting Agencies

Copyright (c) 2026 Authors

This work is licensed under a Creative Commons Attribution 4.0 International License.

This site is licensed under a Creative Commons Attribution 4.0 International License (CC BY 4.0).

Prof. Zhigeng Pan

Professor, Hangzhou International Innovation Institute (H3I), Beihang University, China

Prof. Jianrong Tan

Academician, Chinese Academy of Engineering, China

Conference Time

December 15-18, 2025

Conference Venue

Hong Kong Convention and Exhibition Center (HKCEC)

...

Metaverse Scientist Forum No.3 was successfully held on April 22, 2025, from 19:00 to 20:30 (Beijing Time)...

We received the Scopus notification on April 19th, confirming that the journal has been successfully indexed by Scopus...

We are pleased to announce that we have updated the requirements for manuscript figures in the submission guidelines. Manuscripts submitted after April 15, 2025 are required to strictly adhere to the change. These updates are aimed at ensuring the highest quality of visual content in our publications and enhancing the overall readability and impact of your research. For more details, please find it in sumissions...

.jpg)

.jpg)