A portfolio optimization model under uncertain random environment

Vol 2, Issue 1, 2024

Download PDF

Abstract

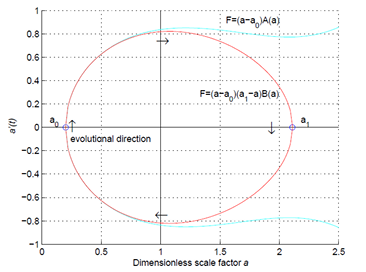

Uncertain events frequently occur in today’s financial markets. Consequently, the issue of portfolio selection is becoming increasingly significant. This paper thoroughly considers the complexities of stock returns in real-world scenarios and employs uncertain differential equations (UDE), uncertain time series analysis (UTSA), stochastic differential equations (SDE), and random time series analysis (RTSA) to predict stock returns, thereby enhancing the accuracy of these predictions. Furthermore, this paper addresses investors’ preferences and the limitations of using variance as a measure of investment risk. It introduces a risk preference factor and proposes an uncertain random mean-lower variance model. Finally, a genetic algorithm is utilized to solve the model, and numerical simulations are conducted to demonstrate the model’s practicality.

Keywords

References

- Markowitz H. Portfolio selection*. The Journal of Finance. 1952; 7(1): 77-91. doi: 10.1111/j.1540-6261.1952.tb01525.x

- Jin Y, Zhang W. Robust portfolio optimization with higher moments. Mathematical Finance, 2021, 31(4): 1132-1165.

- Yang J, Li Y. Stochastic dominance and portfolio optimization. Review of Financial Studies, 2024, 37(1): 50-78.

- Konno H, Suzuki K ichi. A mean-variance-skewness portfolio optimization model. Journal of the Operations Research Society of Japan. 1995; 38(2): 173-187. doi: 10.15807/jorsj.38.173

- Huang X. Portfolio selection with a new definition of risk. European Journal of Operational Research. 2008; 186(1): 351-357. doi: 10.1016/j.ejor.2007.01.045

- Krejić N, Kumaresan M, Rožnjik A. VaR optimal portfolio with transaction costs. Applied Mathematics and Computation. 2011; 218(8): 4626-4637. doi: 10.1016/j.amc.2011.10.047

- Li B, Shu Y. The skewness for uncertain random variable and application to portfolio selection problem. Journal of Industrial & Management Optimization. 2022; 18(1): 457. doi: 10.3934/jimo.2020163

- Li J, Liu X. GARCH model with fractional Brownian motion correction. Statistics and Decision, 2021, 1(5): 29-33.

- Konno H, Shirakawa H, Yamazaki H. A mean-absolute deviation-skewness portfolio optimization model. Annals of Operations Research. 1993; 45(1): 205-220. doi: 10.1007/bf02282050

- Farrar D. The Investment decision under Uncertainty. Prentice Hall, Englewood Cliffs, New Jersey, 1962.

- Li X, He L. Higher-order moments and risk management in portfolio optimization. Quantitative Finance, 2023, 23(1): 57-76.

- Wang Z, Liu Q. Incorporating higher-order moments into portfolio construction under uncertainty. Review of Financial Studies, 2024, 37(3): 987-1020.

- Zadeh L. Fuzzy sets. Information and Control, 1965, 8(3): 338-353.

- Deng X, Li R. A portfolio selection model with borrowing constraint based on possibility theory. Applied Soft Computing. 2012; 12(2): 754-758. doi: 10.1016/j.asoc.2011.10.017

- Pahade JK, Jha M. Credibilistic variance and skewness of trapezoidal fuzzy variable and mean–variance–skewness model for portfolio selection. Results in Applied Mathematics. 2021; 11: 100159. doi: 10.1016/j.rinam.2021.100159

- Liu B. Uncertainty Theory, 2nd ed Springer-Verlag, Berlin, 2007.

- Liu B. Uncertainty Theory: A Branch of Mathematics for Modeling Human Uncertainty. Springer-Verlag, Berlin, 2010.

- Yu L, Wang L. Uncertainty Modeling in Portfolio Optimization: A Review. European Journal of Operational Research, 2021, 293(2): 645-659.

- Cai X, Zhu H. Robust Portfolio Optimization under Uncertainty with Conditional Value-at-Risk. Operations Research Letters, 2022; 50(1): 82-90.

- Liu S, Zhou X. Dynamic Portfolio Optimization with Uncertainty: A Stochastic Programming Approach. Mathematical Finance, 2023; 33(3): 678-705.

- Liu Y. Uncertain random variables: a mixture of uncertainty and randomness. Soft Computing. 2012; 17(4): 625-634. doi: 10.1007/s00500-012-0935-0

- Qin Z. Mean-variance model for portfolio optimization problem in the simultaneous presence of random and uncertain returns. European Journal of Operational Research. 2015; 245(2): 480-488. doi: 10.1016/j.ejor.2015.03.017

- Mehlawat MK, Gupta P, Khan AZ. Portfolio optimization using higher moments in an uncertain random environment. Information Sciences. 2021; 567: 348-374. doi: 10.1016/j.ins.2021.03.019

- Treanja, S. LU-Optimality Conditions in Optimization Problems with Mechanical Work Objective Functionals. IEEE Transactions on Neural Networks and Learning Systems, 2021.

- Holland J. Adaptation in natural and artificial systems. University of Michigan Press, New York, 1975.

- Kaya O, Schildbach J, Schneider S, Darius R. Robo-advice-a true innovation in asset management, Deutsche Bank Research, 2017.

- DeMiguel V, Garlappi L, Uppal R. Optimal Versus Naive Diversification: How Inefficient is the 1/NPortfolio Strategy? Review of Financial Studies. 2007; 22(5): 1915-1953. doi: 10.1093/rfs/hhm075

- Kearney C, Liu S. Textual sentiment in finance: A survey of methods and models. International Review of Financial Analysis. 2014; 33: 171-185. doi: 10.1016/j.irfa.2014.02.006

- Yao K, Chen X. A numerical method for solving uncertain differential equations. Journal of Intelligent & Fuzzy Systems. 2013; 25(3): 825-832. doi: 10.3233/ifs-120688

- Liu B. Uncertainty Theory, 4th ed Springer Berlin Heidelberg; 2015. doi: 10.1007/978-3-662-44354-5

- Ye T, Liu B. Uncertain hypothesis test with application to uncertain regression analysis. Fuzzy Optimization and Decision Making. 2021; 21(2): 157-174. doi: 10.1007/s10700-021-09365-w

- Phillips PCB, Perron P. Testing for a unit root in time series regression. Biometrika. 1988; 75(2): 335-346. doi: 10.1093/biomet/75.2.335

- Akhter MF, Hassan D, Abbas S. Predictive ARIMA Model for coronal index solar cyclic data. Astronomy and Computing. 2020; 32: 100403. doi: 10.1016/j.ascom.2020.100403

- Evans L. An Introduction to Stochastic Differential Equations. 2013. doi: 10.1090/mbk/082

- Harlow WV, Rao RKS. Asset Pricing in a Generalized Mean-Lower Partial Moment Framework: Theory and Evidence. The Journal of Financial and Quantitative Analysis. 1989; 24(3): 285. doi: 10.2307/2330813

- Yang X, Liu B. Uncertain time series analysis with imprecise observations. Fuzzy Optimization and Decision Making. 2018; 18(3): 263-278. doi: 10.1007/s10700-018-9298-z

- Yao K, Liu B. Parameter estimation in uncertain differential equations. Fuzzy Optimization and Decision Making. 2019; 19(1): 1-12. doi: 10.1007/s10700-019-09310-y

Supporting Agencies

Copyright (c) 2024 Yanrui Su, Yanjiao Song, Chenyi Liu

License URL: https://creativecommons.org/licenses/by/4.0/

Editor-in-Chief

Prof. Youssri Hassan Youssri

Cairo University, Egypt

Asia Pacific Academy of Science Pte. Ltd. (APACSCI) specializes in international journal publishing. APACSCI adopts the open access publishing model and provides an important communication bridge for academic groups whose interest fields include engineering, technology, medicine, computer, mathematics, agriculture and forestry, and environment.

.jpg)

.jpg)