Pricing of European call options using generalized Wishart processes

Vol 1, Issue 1, 2023

Download PDF

Abstract

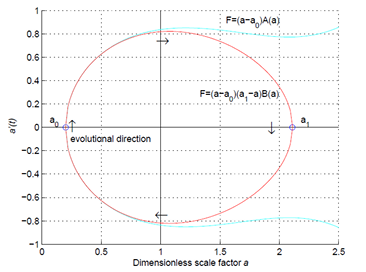

This study explores a multiple-security, high-risk pricing model where the implied volatility has been portrayed through Generalized Wishart affine processes. The presence of dual dependency matrices distinctively characterizes this multifaceted model. These matrices encapsulate the relationship between the generalized Wishart processes and the evolving dynamics of several securities. The adaptability of the proposed model makes it a perfect fit for high-frequency market data, whether dealing with either long or short-term maturities of calls. The main objective paper is on its derivation and addressing the call option pricing problem within the context of the volatility mode using generalized Wishart stochastic. A combination of Fourier transforms techniques and perturbation methods are utilized, mainly focusing on pricing European call options. The model proposed in this study is theoretical and practical, showcasing the strong potential for real-world applications within the financial derivative market.

Keywords

References

- Ahdida A, Alfonsi A. Exact and high-order discretization schemes for Wishart processes and their affine extensions. The Annals of Applied Probability 2013; 23(3): 1025–1073. doi: 10.1214/12-AAP863

- Christoffersen P, Heston S, Jacobs K. The shape and term structure of the index option smirk: Why multifactor stochastic volatility models work so well. Management Science 2009; 55(12): 1914–1932. doi: 10.2139/ssrn.1447362

- Odhiambo JO. Stochastic Modelling of Systematic mortality Risk Under Collateral Data and Its Applications [PhD thesis]. University of Nairobi; 2022.

- Gourieroux C. Continuous time Wishart process for stochastic risk. Econometric Reviews 2006; 25(2–3): 177–217. doi: 10.1080/07474930600713234

- Heston SL. A closed-form solution for options with stochastic volatility with applications to bond and currency options. The Review of Financial Studies 1993; 6(2): 327–343.

- Shreve SE. Stochastic Calculus for Finance II: Continuous-Time Models. Springer Science & Business Media; 2004. Volume 11.

- Bjork T. Arbitrage Theory in Continuous Time. Oxford university press; 2009.

- Bru MF. Wishart processes. Journal of Theoretical Probability 1991; 4(4): 725–751. doi: 10.1007/BF01259552

- Duffie D, Pan J, Singleton K. Transform analysis and security pricing for affine jump-diffusions. Econometrical 2000; 68(6): 1343–1376. doi: 10.1111/1468-0262.00164

- Odhiambo J, Weke P, Wendo J. Modeling of returns of Nairobi securities exchange 20 share index using log-normal distribution. Research Journal of Finance and Accounting 2020; 11(8): 2222–2847. doi: 10.7176/RJFA/11-8-08

- Kang C, Kang W. Exact simulation of Wishart multidimensional stochastic volatility model. Available online: https://arxiv.org/abs/1309.0557 (accessed on 2 September 2013).

- Chandru M, Prabha T, Das P, Shanthi V. A numerical method for solving boundary and interior layers dominated parabolic problems with discontinuous convection coefficient and source terms. Differential Equations and Dynamical Systems 2019; 27: 91–112. doi: 10.1007/s12591-017-0385-3

- Odhiambo J, Onsongo W, Osman S. An analytical comparison between Python vs R programming languages. Which one is the best for machine learning and deep learning? 2020.

- Odhiambo J, Ngare P, Weke P. Bühlmann credibility approach to systematic mortality risk modeling for sub-Saharan Africa populations (Kenya). Research in Mathematics 2022; 9(1): 2023979. doi: 10.1080/27658449.2021.2023979

- Naryongo R, Onyango J, Njagi L, Nakirya M. Modeling of covid-19 transmission under Markov chains in Uganda. Journal of Applied Mathematics and Computation 2022; 6(1): 4–12. doi: 10.26855/jamc.2022.03.002

- Odhiambo J, Weke P, Ngare P. Modeling Kenyan economic impact of corona virus in Kenya using discrete-time Markov chains. Journal of Finance and Economics 2020; 8(2): 80–85. doi: 10.12691/jfe-8-2-5

- Benabid A, Bensusan H, El Karoui N. Wishart stochastic volatility: Asymptotic smile and numerical framework. Available online: https://hal.science/hal-00458014v2/document (accessed on 18 July 2023).

- Filipovic D, Mayerhofer E. Affine diffusion processes: Theory and applications. Advanced Financial Modelling 2009; 8: 1–40. doi: 10.48550/arXiv.0901.4003

- Carr P, Madan D. Option valuation using the fast Fourier transform. Journal of Computational Finance 1999; 2(4): 61–73.

- Odhiambo JO. Deep learning incorporated Bühlmann credibility in the modified lee—carter mortality model. Mathematical Problems in Engineering 2023; 2023: 8543909. doi: 10.1155/2023/8543909

- Black F, Scholes M. The pricing of options and corporate liabilities. Journal of Political Economy 1973; 81(3): 637–654. doi: 10.1142/9789814759588_0001

- Fouque JP, Papanicolaou G, Sircar R, Solna K. Singular perturbations in option pricing. SIAM Journal on Applied Mathematics 2003; 63(5): 1648–1665. doi: 10.1137/S0036139902401550

- Das P, Rana S, Ramos H. Homotopy perturbation method for solving Caputo‐type fractional‐order Volterra‐Fredholm integro‐differential equations. Computational and Mathematical Methods 2019; 1(5): e1047. doi: 10.1002/cmm4.1047

- Odhiambo JO, Ngare P, Weke P, Otieno RO. Modelling of COVID-19 transmission in Kenya using compound Poisson regression model. Journal of Advances in Mathematics and Computer Science 2020; 101: 111.

- Da Fonseca J, Grasselli M, Tebaldi C. A multifactor volatility Heston model. Quantitative Finance 2008; 8(6): 591–604. doi: 10.1080/14697680701668418

- Odhiambo JO. Stochastic Modelling of Systematic mortality Risk Under Collateral Data and Its Applications [PhD thesis]. University of Nairobi; 2022.

- Benabid A, Bensusan H, El Karoui N. Wishart stochastic volatility: Asymptotic smile and numerical framework. Available online: https://hal.science/hal-00458014v2/document (accessed on 18 July 2023).

- Das P. A higher order difference method for singularly perturbed parabolic partial differential equations. Journal of Difference Equations and Applications 2018; 24(3): 452–477. doi: 10.1080/10236198.2017.1420792

- Shakti D, Mohapatra J, Das P, Vigo-Aguiar J. A moving mesh refinement based optimal accurate uniformly convergent computational method for a parabolic system of boundary layer originated reaction—diffusion problems with arbitrary small diffusion terms. Journal of Computational and Applied Mathematics 2022; 404: 113167. doi: 10.1016/j.cam.2020.113167

- Das P, Rana S. Theoretical prospects of fractional order weakly singular Volterra Integro differential equations and their approximations with convergence analysis. Mathematical Methods in the Applied Sciences 2021; 44(11): 9419–9440. doi: 10.1002/mma.7369

- Das P, Vigo-Aguiar J. Parameter uniform optimal order numerical approximation of a class of singularly perturbed system of reaction diffusion problems involving a small perturbation parameter. Journal of Computational and Applied Mathematics 2019; 354: 533–544. doi: 10.1016/j.cam.2017.11.026

- Shakti D, Mohapatra J, Das P, Vigo-Aguiar J. A moving mesh refinement based optimal accurate uniformly convergent computational method for a parabolic system of boundary layer originated reaction—diffusion problems with arbitrary small diffusion terms. Journal of Computational and Applied Mathematics 2022; 404: 113167. doi: 10.1016/j.cam.2020.113167

- Das P, Rana S, Vigo-Aguiar J. Higher order accurate approximations on equidistributed meshes for boundary layer originated mixed type reaction diffusion systems with multiple scale nature. Applied Numerical Mathematics 2020; 148: 79–97. doi: 10.1016/j.apnum.2019.08.028

- Shreve SE. Stochastic Calculus for Finance II: Continuous-Time Models. Springer Science & Business Media; 2004. Volume 11.

- Das P, Rana S, Ramos H. A perturbation-based approach for solving fractional-order Volterra–Fredholm integro differential equations and its convergence analysis. International Journal of Computer Mathematics 2020; 97(10): 1994–2014. doi: 10.1080/00207160.2019.1673892

- Das P, Rana S, Ramos H. A perturbation-based approach for solving fractional-order Volterra–Fredholm integro differential equations and its convergence analysis. International Journal of Computer Mathematics 2020; 97(10): 1994–2014. doi: 10.1080/00207160.2019.1673892

- Das P, Rana S, Ramos H. Homotopy perturbation method for solving Caputo‐type fractional‐order Volterra‐Fredholm integro‐differential equations. Computational and Mathematical Methods 2019; 1(5): e1047. doi: 10.1002/cmm4.1047

- Odhiambo JO, Okungu JO, Mutuura CG. Stochastic modeling and prediction of the COVID-19 spread in Kenya. Engineering Mathematics 2020; 4(2): 31–35. doi: 10.11648/j.engmath.20200402.12

Supporting Agencies

Copyright (c) 2023 Joab Onyango Odhiambo

License URL: https://creativecommons.org/licenses/by/4.0/

Editor-in-Chief

Prof. Youssri Hassan Youssri

Cairo University, Egypt

Asia Pacific Academy of Science Pte. Ltd. (APACSCI) specializes in international journal publishing. APACSCI adopts the open access publishing model and provides an important communication bridge for academic groups whose interest fields include engineering, technology, medicine, computer, mathematics, agriculture and forestry, and environment.

.jpg)

.jpg)